VA Loans with Tax Lien

This guide will cover qualifying for VA loans with tax lien. For veterans, the dream of owning a home always remained just that – a dream. The reason is the same one that many prospective homebuyers face in financing. However, the government did realize this problem and acted accordingly. This is where the VA loan program was introduced, and its main aim is to offer an excellent opportunity for service members and veterans to realize their lifelong dream.

With its flexible terms, competitive interest rates, and accessible down payment requirements, the VA loan has been a lifeline for countless military personnel. VA loans have one approval rate of all mortgage programs. But some borrowers would still face challenges and uncertainty in obtaining this loan, especially those burdened by the weight of a tax lien.

So, if you are such a borrower, it is important to understand how the tax liens impact your VA loan eligibility. Still, most importantly, you would want to know the specific steps to take to navigate this obstacle. Well, lucky you, as this is what this article is all about; telling you about the intricacies of VA loans with tax lien. We will cover how you can overcome the challenges when getting approved for VA loans with tax lien.

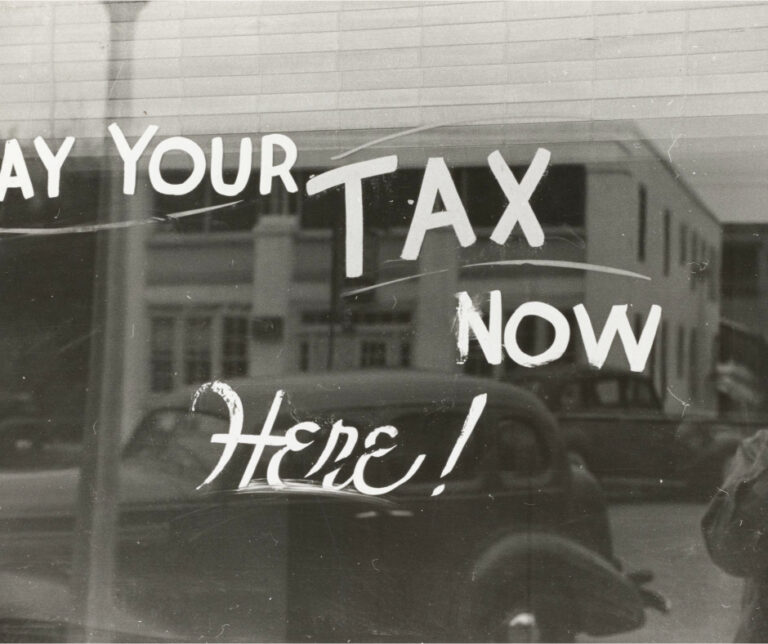

What are tax liens?

Tax liens are legal claims imposed on an individual taxpayer’s assets, such as real estate, bank accounts, vehicles, and other assets, by a government entity such as the IRS due to unpaid tax debts. When citizens pay taxes, the government can file a tax lien to secure the

de and protect its interests. Remember that the government always has a right to collect unpaid taxes, so a tax lien essentially gives them a legal claim over the individual’s assets.

Please note that the lien doesn’t necessarily mean that the property will be sold; it simply means that should other creditors decide to come after the individuals’ assets, the tax authority will always get the first claim. This also means that the federal tax debt will remain if the individual files for bankruptcy while all the other debts are wiped out.

A tax lien hurts a borrower’s creditworthiness and financial standing, making engaging in certain financial transactions more difficult once the tax debt is resolved. As the tax liens are typically public records, they negatively impact a person’s report and credit score, and you pay penalties and interest due to the outstanding tax debt. The best way to get out of a tax lien would be to clear all the taxes owed. There are steps for borrowers to take to qualify for VA loans with tax lien.

Solutions To Get Approved For VA Loans With Tax Lien

Borrowers can enter into a written payment plan with the Internal Revenue Service. The IRS will consider releasing the tax lien if a borrower agrees to a payment plan that involves an on-time monthly payment until the debt is satisfied. Three monthly payments must be made timely once the borrower has a written payment agreement with the IRS. You can try to get a property discharge. The taxpayer can discharge specific property, effectively removing it from the lien. However, not all the properties are eligible for the discharge. You can qualify for VA loans with tax lien if you get the IRS to subordinate the tax lien. The IRS can subordinate a federal tax lien if you are on a written payment agreement.”

Subordination is a legal process where a tax authority (IRS) agrees to lower the priority of its claim on a taxpayers property, allowing another creditor to have a higher priority in the event of a foreclosure or sale. When you apply for such an action, you may be able to obtain another mortgage or loan.

Withdrawal notice – a borrower can also apply for a withdrawal notice, which essentially removes the public notice of the lien. Borrowers will still be responsible for the debt, but if approved, the tax authority will not compete with other creditors for their property. It’s important to note that tax liens can vary in severity and impact based on specific circumstances and jurisdiction. It is crucial to consult with a tax consultant for the implications of a tax lien and explore the appropriate steps to resolve the debt.

How Can You Qualify For VA Loans With Tax Lien

Let’s begin by saying that individual lenders may view tax liens differently. For many, moving forward with the loan process is still possible, even with an outstanding tax lien. Ideally, you need to prove to the lender that you are making payments toward the tax debt. But

even with all that, there are things to remember when applying for a VA loan with a tax lien. Borrowers need to have timely payment history for the past 12 months to get an approve/eligible per automated underwriting system on VA loans. John Strange, a VA loan expert at Mortgage Lenders For Bad Credit, advises the following:

Many VA lenders require a satisfactory credit history to qualify a borrower. And since a tax lien dents your credit score and financial standing, it is slightly more challenging to meet the requirements for a VA loan. You need a written payment agreement to prove your commitment to resolving the tax lien to the lender. Remember, lenders will always review your credit report and consider the presence of a tax lien as part of their evaluation.

Before you are even considered for a VA loan, a borrower must address their outstanding tax liens by paying the tax debt or agreeing to a payment plan. It is essential to put everything in writing for easier reference or to present it to the lender when applying for the mortgage.

VA Loans With Tax Lien Eligibility Guidelines

While the VA mortgage program doesn’t have specific guidelines regarding tax liens, individual lenders may have their policies and requirements. You will find that some lenders may be more flexible in considering applicants with tax liens, while others may have stricter criteria. It is crucial to discuss your situation with multiple lenders to understand their specific policies and determine your options. Dale Elenteny, an expert on VA loans, shares his expertise in qualifying for VA loans with tax lien:

After resolving the tax lien, you need to understand that things don’t end there; you will still need to work on your financial profile, including credit score, income, employment history, and other debts. This is because the lenders will still evaluate your financial situation to assess your ability to repay the loan and determine your creditworthiness beyond the tax lien.

The other thing you need to remember is to qualify for VA loans with tax lien, recent lien can also be a crucial factor in determining your eligibility for the loan. This is because the lenders may want to see a sufficient period passing since the liens resolution to ensure that it is not recurring and that you have established a stable financial track record.

Do All Lenders Have the Same VA Loans With Tax Lien Guidelines

Not all mortgage companies have the same guidelines on VA loans with tax lien. Lenders often have overlays which means additional guidelines higher than the minimum agency guidelines of the Veterans Administration. Ronda Butts, a dually licensed realtor and loan officer at Mortgage Lenders For Bad Credit, said the following about qualifying for VA loans with tax lien:

Homebuyers can qualify for VA loans with tax lien. While a tax lien presents some challenges to borrowers seeking VA loans, you should still pursue your homeownership dream. With knowledge, persistence, and the support of knowledgeable professionals, it is possible to overcome the obstacles that tax liens may pose.

You can start by diligently resolving the tax lien, demonstrating responsible financial management, and working with lenders experienced in VA loans. This way, you can navigate the complexities and secure the financing for your future home. The VA program was specially designed for service members looking to own homes and is a clear testament to the nation’s commitment to supporting them. With determination and the right resources, you should be able to utilize this program to make your homeownership aspirations a reality for you and your family.