VA Loans With Charge-Offs

This guide covers qualifying and getting pre-approved for VA loans with charge-offs.VA loans are one of the financing options known to offer numerous advantages to borrowers compared to all other types of loans. They are designed to support and honor our veterans and active-duty military personnel and, quite frankly, have long been a beacon of hope for those seeking to own a home.

The loans are renowned for their flexible terms, competitive interest rates, and the ability to purchase a home with little to no down payment. While obtaining this loan with a clean credit history can be straightforward, we can’t say the same about those who have encountered financial setbacks at some point, such as charged-off accounts.

The truth is that charged-off accounts dent a borrower’s credit history, making obtaining a loan more challenging. The good news, however, is that you can do something to make the process easier. We will tell you all about it in this article. After explaining what charged-off accounts are, we will tell you their implications for VA loan applications and the strategies you can employ to improve your creditworthiness. In the following paragraphs, we will cover getting approved for VA loans with charge-offs.

What are charge-off Accounts?

Simply put, a charged-off account is an accounting term used by lenders to indicate that they no longer consider debt as an asset. When a borrower fails to make payments for an extended period, typically six months or more, the lender may determine that the debt is unlikely to be collected. As a result, they remove the debt from their active accounts receivable and charge it off as a loss. However, this does not mean that your debt obligation has been absolved. On the contrary, you are still legally responsible for repaying the outstanding amount, even though the lender no longer considers it an active account.

When your account is charged off, it can significantly negatively impact your credit score. For instance, the charge-off remains on your credit report for up to seven years from the date of the first missed payment, serving as a red flag for future lenders. This negative entry signals that you had a significant delinquency or default on your credit history.

Furthermore, the missed payments leading up to the charge-off negatively impact your credit score. Remember, late payments are typically reported to credit bureaus each month, and consistent delinquencies can lower your credit score. A lower credit score can make it more challenging to obtain credit in the future and may result in higher interest rates or unfavorable terms when you qualify. This is why taking proactive steps to rebuild your credit after a charged-off account is crucial to mitigate the long-term consequences.

Understanding VA loan eligibility

First, VA loans are a mortgage program for veterans, active-duty military members, and eligible surviving military spouses. Private lenders, banks, and mortgage companies provide the loans. Still, they are guaranteed or insured by the Department of Veteran Affairs (VA) and offer favorable terms and benefits to the borrowers. Here are the key requirements for obtaining a VA loan

- Eligible borrowers – not everybody is eligible for this loan. Only veterans who were honorably discharged, active-duty service members with at least 90 consecutive days in the service, National Guard members with at least 90 days of active duty, and reserve members with the same period of active duty. It is also available for surviving military spouses.

- Certificate of Eligibility – to prove eligibility for a VA loan, borrowers need to obtain a Certificate of Eligibility (COE) from the VA, verifying their military service or surviving spouse status. It can be obtained through the VA directly or with the assistance of a VA-approved lender.

- Property Eligibility – VA loans can purchase various properties, including single-family homes, condominiums, and multi-unit properties (up to four units). The financed property must be intended for the borrower’s primary residence.

- Credit and income requirements – even though the VA doesn’t set a minimum credit score requirement, VA lenders do. For this reason, the credit score requirements vary by lender, with most requiring a score of 620 and above to obtain financing. In addition to the credit score, the VA requires borrowers to maintain a certain amount of income every month after paying all their bills. This is what is referred to as residual income. These requirements increase the chances of borrowers meeting their financial obligations, which, in turn, reduces your chances of default.

- Funding fee – VA loans typically require a funding fee, which helps sustain the VA loan program. The fee varies based on factors such as the borrower’s military category, the down payment amount (if applicable), and whether it is the borrower’s first or subsequent VA loan.

Please remember that while the VA guarantees a portion of the loan, private lenders still provide VA loans. Therefore, meeting the eligibility requirements does not automatically guarantee approval, as lenders may have additional criteria and underwriting standards.

Impact of getting approved for VA loans with Charge-Offs

Having looked at qualifying for VA loans with charge-offs, let’s examine how they can impact your VA loan eligibility. While VA loans are generally known for their flexibility and accommodating nature, charged-off accounts may raise concerns for lenders evaluating a borrower’s creditworthiness. Here are some of the common impacts:

- Credit score assessment – when reviewing a VA loan application, lenders assess the borrower’s creditworthiness, which includes reviewing their credit score and credit history. Charged-off accounts, especially recent ones, can significantly lower a borrower’s credit score and raise concerns about their ability to manage debt responsibly.

- Minimum credit score requirements – the VA itself does not have a specific minimum requirement for credit scores requirement; however, private lenders who provide VA loans typically have their minimum credit score criteria. If a borrower’s credit score falls below the lender’s threshold, getting approved for a VA loan can make it more challenging.

- Underwriting considerations – when evaluating a loan application, lenders also consider the borrower’s overall credit profile, including the presence of charged-off accounts. Lenders may look for patterns or indications of financial distress, such as multiple charged-off accounts or a history of delinquencies. VA allows manual underwriting, but the borrower needs timely payments in the past 12 months.

- Timeliness of charged accounts – the recency of the charged-off accounts can also impact the approval process. More recent charged-off accounts may raise more significant concerns for lenders than older ones, as they may perceive the borrower’s financial management as more risky or unstable. Remember, while charged-off accounts may impact the loan approval process, they do not automatically disqualify borrowers from obtaining a VA loan. There are a couple of strategies you can employ to boost your creditworthiness.

Strategies for Overcoming Qualifying for VA Loans with Charge-Offs

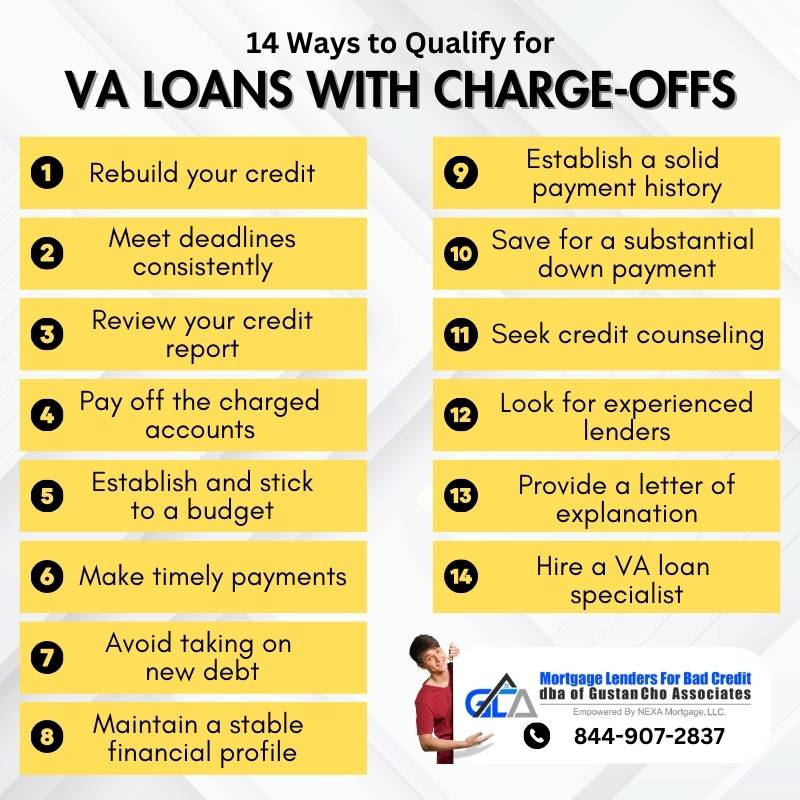

You can take a few proactive steps to demonstrate your financial stability to VA lenders to qualify for VA loans with charge-offs. They include the following:

- Rebuilding your credit – first, you must focus on rebuilding your credit by establishing positive financial habits. You can start by making on-time payments on your current debts, including cards, loans, and utility bills. You need to ensure that you meet the payment.

- Deadlines consistently – This will demonstrate new-found financial responsibility, improving your credit score over time. Here is a more detailed step-by-step guide on how to go about rebuilding your credit:

- Review your credit report – you can start by obtaining a free copy of your credit report from each of the three credit bureaus in the country (Equifax, Experian, and TransUnion). Then carefully review the reports for inaccuracies, errors, or outdated information related to the charged-off accounts. If any, you can dispute them immediately through the laid out dispute processes.

- Settle or pay off the charged accounts – you should then pay off the charged-off accounts, which would be the most obvious way of resolving the issue. Explore options to settle the debts or establish payment plans with lenders or collection agencies. Paying off or making regular payments on the outstanding balances shows responsibility and a commitment to resolving your financial obligations and would go a long way in cleaning your credit history.

- Establish and stick to a budget – you should also consider creating a realistic monthly budget that accounts for your income, expenses, and debt payments. Then, prioritize debt repayment and allocate funds to pay off all your outstanding debts, including charged-off accounts. Ensure you have enough monthly money to make all required payments on time.

- Make timely payments – always ensure you pay all your bills, including credit cards, loans, and utilities, on time every month. When you make a late payment, you further damage your credit score.

- Avoid taking on new debt – while having an active credit history is important, it’s equally crucial to avoid accumulating new debt as it might negatively affect your creditworthiness. Just focus on paying off the existing debt, which will, in turn, improve your credit utilization ratio.

- Maintain a stable financial profile – first, lenders across the country value stability, and it is one of the most crucial elements they will heavily assess whenever you make a loan application. Therefore, you need to maintain a steady source of income and avoid significant financial changes, such as changing jobs or incurring new debts, during the loan application process or the time leading up to the application process. A stable financial profile reassures the lender of your ability to manage future mortgage payments.

- Establish a solid payment history – the other crucial element to getting out of your financial setback is building a positive payment history. Doing this demonstrates your commitment to meeting financial responsibilities and can help offset the negative impact of charged-off accounts. You must consistently make on-time payments for all your financial obligations, including rent, utilities, and other loans.

- Save for a substantial down payment – while VA loans offer the benefit of no down payment or low down payment options, saving for a down payment can be advantageous. A larger down payment can offset the perceived risk associated with charged-off accounts and demonstrate your financial stability to lenders.

- Seek credit counseling – we also highly recommend consulting a credit counseling agency to develop a personalized plan for improving your creditworthiness. Credit counselors can offer guidance, negotiate with creditors on your behalf, and provide effective financial management strategies.

- You may also want to look for lenders experienced in such credit challenges – the reason being these lenders will usually have specific programs or guidelines in place to help individuals with various financial challenges, such as charge-off accounts. Go online, do your research, read the reviews, and even go as far as interacting with users who have used the lender to get an idea of what working with the lender will be like.

- Provide a letter of explanation – providing a letter where you have detailed all the circumstances leading up to the charge-off and the steps you have taken to address them will also be helpful. The letter provides context and showcases your commitment to financial responsibility.

- Hire a VA loan specialist – partnering with a VA loan specialist or loan officer experienced in handling unique credit situations can be invaluable. They can provide personalized guidance, help you navigate the application process, and connect you with lenders more likely to consider your specific circumstances. Remember that each lender has underwriting guidelines, so exploring multiple options and comparing different offers is crucial.

You need to establish a pattern of consistent, on-time payments, and if you need to, you can set up an automatic reminder for payment to help you stay on track. You can also consider taking a secured credit card or small loan. The secured credit card requires a cash deposit as collateral and can be a valuable tool for rebuilding credit. However, you must use the secured credit card responsibly by making small purchases and paying off the monthly balance. Alternatively, consider obtaining a small secured loan, such as a credit builder loan, and make timely payments to demonstrate responsible borrowing behavior.

The role of credit repair companies in resolving charged-off accounts

Are you looking for even better results? Consider hiring a credit company that will assist you in resolving the charged-off accounts and helps you understand everything better so that you can know better in the future. Here is an overview of the role of credit companies:

- Reviewing the credit reports – if you don’t have the time to do it yourself or don’t know how to check your reports properly, the company you hire does all the work for you. They will get the reports, analyze them for inaccuracies, and in case of any, they will dispute them

immediately. You can relax and let them handle everything. - Disputing inaccuracies – when it comes to disputing errors, the process itself might be a bit tedious, and if you don't have the time to do it, this company has the experience to navigate the entire process. They will draft the dispute letters, manage the communication with the bureaus, and keep track of the resolution process, ensuring the deadlines are met.

- Negotiating with creditors is the most crucial aspect of hiring a credit company. These companies have a lot of experience and can negotiate a great deal on your behalf with the creditors. They can attempt to negotiate settlements or payment arrangements that are more favorable to you, such as reduced payoff amounts or deletion of the charged-off status upon payment.

- Providing credit education – Lastly, reputable companies often offer educational resources and guidance that help you understand debt management, credit scoring, and responsible financial behavior. They can also provide personalized advice on improving your credit and maintaining healthy financial habits. However, it is crucial to exercise caution when working with these companies. Here are some crucial considerations:

- Properly research and select the right company – take the time to research and select credit repair companies with a solid reputation and positive reviews from trustworthy sources. Also, ensure that the company you select adheres to ethical practices and complies with applicable regulations, such as the Credit Repair Organization Act (CROA).

- Understand the limitations –let’s face it, credit repair companies cannot guarantee specific outcomes or instant results. They also cant remove accurate and verifiable information from your credit report, including valid charged-off accounts. Therefore, you must be wary of any company that promises to completely erase your negative credit history or create a new credit identity.

- Cost considerations – obviously, credit repair companies charge a fee for their services. You need to consider this cost when you evaluate benefits vis-à-vis the expenses. Also, ensure you understand the fees upfront and any cancellation policies before entering into an agreement.

- DIY options – last but not least, remember that hiring a credit repair company is just an option you have. You don’t have to do it; you can still do everything yourself. This way, you will be able to save a lot of money, but you will have to put in a lot of effort, time, and a thorough understanding of the process.

How Soon Can You Qualify For VA Loans With Charge-Offs

Homebuyers do not have to pay off outstanding charge-off accounts to qualify for VA loans with charge-offs. However, the date of the last activity needs to be at least one year old to qualify for VA loans with charge-offs. While charged-off accounts might challenge veterans or military members when applying for a VA loan, they should never deter them from exploring or working to improve their situation. There are several ways through which you can address the charged-off accounts, as we have outlined in this article. By following these tips, you can demonstrate your commitment to improving your credit history, which is all the lenders will be looking for.

In addition, please pay attention to the recommendation on seeking help and guidance from reputable VA loan specialists and financial advisors, as you will be able to get tailored advice and strategies on boosting your creditworthiness based on your situation.

These professionals can offer valuable insights and assist in building a strong case for loan approval, considering each individual’s unique circumstances. Ultimately, VA loans offer veterans a path to homeownership with favorable terms and conditions. Even with charged-off accounts, you can take control of your financial future and work towards fulfilling your desire to own a home.