FHA Loans With a 500 FICO Credit Score

This guide will cover qualifying and getting approved for FHA loans with a 500 FICO credit score. FHA loans are a popular option for purchasing a home with less-than-perfect credit. However, borrowers with low credit scores may struggle to qualify for an FHA loan. John Strange of Mortgage Lenders For Bad Credit explains his experience in helping borrowers qualify for FHA loans with a 500 FICO score:

The team a Mortgage Lenders For Bad Credit are experts in helping borrowers get approved for VA and FHA loans with a 500 FICO score. Over 80% of our clients are folks who could not qualify at other mortgage companies.

In this blog post, we will explore the ins and outs of FHA loans for borrowers with low credit scores. We will discuss credit score requirements, eligibility, tips for qualifying, and the benefits and risks of FHA loans. By the end of this post, you will better understand what to expect when applying for FHA loans with a 500 FICO credit score and whether it is the right option. In the following sections, we will guide our views how they can qualify for FHA loans with a 500 FICO credit score.

What Are the Eligibility Requirements for FHA Loans with a 500 fICO score?

FHA loans are mortgages insured by the Federal Housing Administration (FHA), part of the U.S. Department of Housing and Urban Development (HUD). FHA loans are designed to help low-to-moderate-income borrowers purchase a home with a lower down payment and credit score requirements than conventional loans. Ethel Matthews of Mortgage Lenders For Bad Credit explains the importance of having a good credit score as follows:

Credit score plays a crucial role in FHA loan applications. HUD, the parent of FHA, requires a minimum credit score of 500 to qualify for an FHA loan with a 10% down payment or a minimum credit score of 580 with a 3.5% down payment.

Borrowers with higher credit scores may be eligible for more favorable interest rates and loan terms. While a low credit score may make qualifying for an FHA loan challenging, it is not necessarily a disqualifying factor. There are still options for borrowers with low credit scores to secure an FHA loan, although they may face additional requirements and higher interest rates.

Credit Score Requirements for FHA Loans

A credit score is a vital factor when securing a mortgage, and this is no exception when it comes to FHA loans. While FHA loans are designed to be more accessible to those with lower credit scores, borrowers still need to meet certain requirements to qualify. The FHA has a minimum credit score requirement of 500 for borrowers with a 10% down payment and 580 for borrowers with a 3.5% down payment.

Lenders may have higher credit score requirements than the FHA minimum. Borrowers with credit scores below the lender’s minimum requirement may not be eligible for an FHA loan. A higher credit score can make qualifying for an FHA loan easier and result in more favorable loan terms, including lower interest rates and smaller down payments.

A higher credit score can also improve a borrower’s approval for other types of loans and credit lines. In addition, a higher credit score can provide peace of mind for the borrower, as it indicates a history of responsible credit use and may make them more attractive to potential lenders. It is important to note that while a higher credit score can be beneficial, it is not the only factor considered in the FHA loan approval process.

Eligibility for FHA Loans with a 500 FICO

To be eligible for an FHA loan with a low credit score, borrowers must meet certain requirements, including the following:

- A minimum credit score of 500 or 580, depending on the down payment amount

- A debt-to-income ratio (DTI) of no more than 43%, though some lenders may allow higher DTIs with compensating factors

- Steady employment and income for the past two years

- Proof of income, such as pay stubs, W-2s, and tax returns

- A down payment of at least 3.5% of the purchase price

- Mortgage insurance premiums (MIP) for the life of the loan

While meeting the above requirements is necessary for eligibility, lenders may also consider other factors impacting a borrower's creditworthiness. For example, lenders may consider the borrower’s rental history, employment history, and other financial assets when

evaluating a borrower’s creditworthiness.

FHA Loans With a 500 FICO Versus Other Mortgage Options

Borrowers who do not meet the eligibility requirements for FHA loans with a 500 FICO may still have alternative options. For example, they may consider a conventional loan, which typically requires a higher credit score and down payment but may offer more favorable terms for borrowers with excellent credit. Dale Elenteny explains the importance of having timely payments in the past 12 months to get an approve/eligible per the automated underwriting system as follows:

Borrowers with a limited credit history or missed payments may face additional scrutiny during the application process.

Additionally, borrowers may consider working with a credit counselor to improve their credit score and overall financial situation before applying for a mortgage. While having a low credit score may present challenges when applying for an FHA loan, borrowers can still improve their creditworthiness and explore alternative options to achieve their homeownership goals.

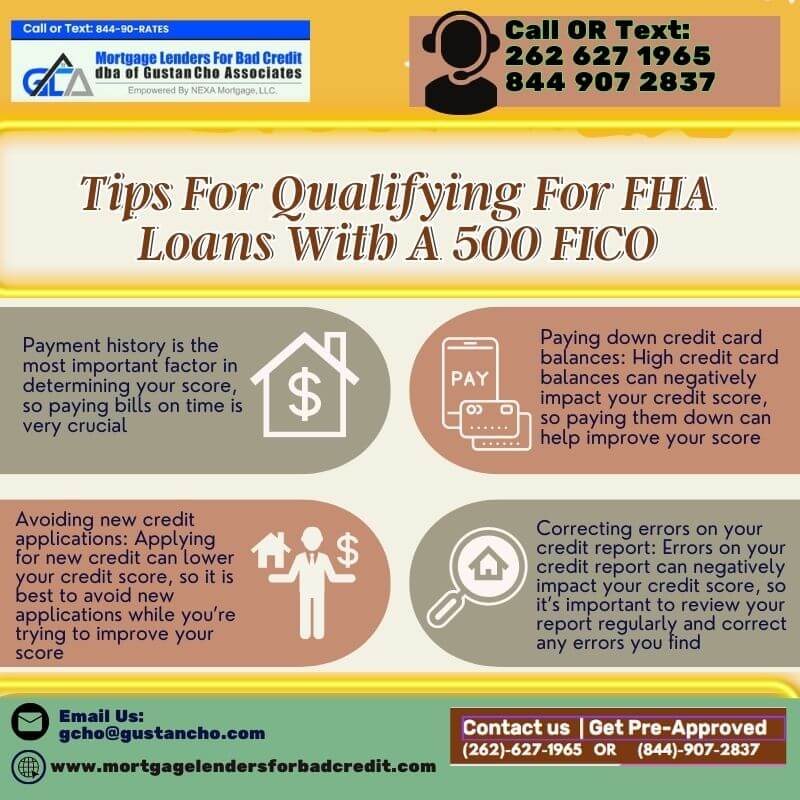

Tips for Qualifying for FHA Loans with a 500 FICO

While credit score requirements for FHA loans are more lenient than those for traditional loans, there are still steps you can take to improve your chances of qualifying for FHA loans with a 500 FICO. Improving your credit score is important in qualifying for FHA loans with a 500 FICO. Some steps you can take to improve your credit score include:

- Paying bills on time: Payment history is the most important factor in determining your score, so paying bills on time is crucial.’

- Paying down credit card balances: High credit card balances can negatively impact your credit score, so paying them down can help improve your score.

- Correcting errors on your credit report: Errors on your credit report can negatively impact your credit score, so it’s important to review your report regularly and correct any errors you find.

Avoiding new credit applications: Applying for new credit can lower your credit score, so it's best to avoid new applications while you’re trying to improve your score.

FHA Loans With a 500 FICO Score debt-to-income Ratio Guidelines

Managing your debt-to-income ratio is also important when applying for an FHA loan with a low credit score. Some ways to manage your debt-to-income ratio include paying down debt: Lowering your debt balances can help improve your debt-to-income ratio and make you a more attractive borrower.

FHA and VA loans are the only two mortgage loan programs that allow manual underwriting. Manual underwriting is the same as automated underwriting system FHA loans. However, there is a restriction of front-end and back-end debt-to-income ratio caps on manual underwriting versus AUS approved FHA loans.

Increasing your income: Increasing your income through a higher-paying job or a side hustle can also help improve your debt-to-income ratio. Working with a credit counselor: A credit counselor can help you develop a plan to manage your debt and improve your overall financial situation.

Options for FHA down payment assistance Loans

Saving for a down payment can be challenging for some borrowers, especially those with low credit scores. However, there are options for down payment assistance, including:

- FHA-approved nonprofit organizations may offer down payment assistance to eligible borrowers.

- State and local programs: Many states and local governments offer down payment assistance programs for first-time homebuyers.

Employer-assisted housing: Some employers offer housing assistance programs as a benefit to employees.

Overall, improving your credit score, managing your debt-to-income ratio, and exploring down payment assistance options can all help you qualify for an FHA loan with a low credit score.

Documents Required to Start Application Process for FHA Loans with A 500 FICO

When applying for an FHA loan with a low credit score, it’s important to be prepared with the necessary documentation and information. Here are some key factors to keep in mind:

- Personal identification such as a driver’s license or passport

- Social Security number

- Employment and income verification, such as pay stubs or W-2s

- Tax returns from the past two years

- Bank statements from the past two to three months

- Information on any outstanding debts or financial obligations

The process for applying for an FHA loan is similar to that of a traditional loan. You’ll start by contacting a lender who offers FHA loans and providing them with the necessary documentation and information. They will then determine your eligibility for an FHA loan based on factors such as your credit score, debt-to-income ratio, and employment and income history.

Timeline for Approval and Funding on FHA Loans With a 500 fICO Score

The timeline for approval and funding for an FHA loan can vary depending on factors such as the complexity of your financial situation and the lender you’re working with. Generally, it’s a good idea to allow for several weeks for approval and up to a month for funding. Be sure to communicate with your lender throughout the process to ensure everything is on track.

FHA loans are designed to make homeownership more accessible for borrowers who may have difficulty qualifying for traditional loans, including those with low credit scores. In the following sections, we will cover some of the benefits of FHA loans with low credit scores for borrowers with under 620 FICO.

One of the primary benefits of FHA loans is that they require a lower down payment than traditional loans. While traditional loans may require a down payment of 20% or more, FHA loans require a down payment of as little as 3.5%. This can be a significant advantage for borrowers with difficulty saving up for a large down payment.

Mortgage rates on FHA Loans With a 500 FICO Scores

FHA loans also have lower credit score requirements than traditional loans. While traditional loans may require a credit score of 620 or higher, FHA loans may be available to borrowers with credit scores as low as 500. This can make homeownership more accessible for borrowers who may have experienced financial difficulties.

While FHA loans can be a great option for borrowers with low credit scores, there are some risks that borrowers should be aware of. Here are some of the potential risks of FHA loans for borrowers with low credit scores:

FHA loans often have competitive interest rates despite the lower credit score and down payment requirements. This can help borrowers save money over the life of their loan and make homeownership more affordable in the long run. FHA loans can be a great option for borrowers with low credit scores looking to buy a home. Be sure to work with a knowledgeable lender who can guide you through the process and help you take advantage of all the benefits of FHA loans.

How To Get FHA Loans With a 500 FICO With Best Rates

While FHA loans may offer competitive interest rates, borrowers with low credit scores may be subject to higher interest rates than those with higher credit scores. This is because lenders may view borrowers with lower credit scores as riskier and charge a higher interest rate to offset that risk.

FHA loans require borrowers to pay mortgage insurance premiums (MIP) for monthly mortgage payments. This insurance protects the lender if the borrower defaults on the loan. For borrowers with low credit scores, the MIP can be particularly expensive. In addition, FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing, which can be a significant expense.

FHA loans have borrowing limits, which vary depending on the property’s location. In some high-cost areas, the borrowing limits may be higher, but in others, the borrowing limits may be lower. Borrowers with low credit scores may be further limited in their borrowing capacity, as lenders may be less willing to extend larger loans to borrowers with lower credit scores.

Best Mortgage Lenders For FHA Loans With a 500 FICO

FHA loans can be a great option for borrowers with low credit scores looking to buy a home. With lower credit score requirements, lower down payment requirements, and competitive interest rates, FHA loans can make homeownership more accessible to a wider range of borrowers.

Overall, borrowers with low credit scores should carefully consider the risks and benefits of FHA loans before applying. Be sure to work with a knowledgeable lender who can help you understand your options and make an informed decision.

However, it’s important to be aware of the risks associated with FHA loans, including higher interest rates for borrowers with low credit scores, mortgage insurance premiums, and limited borrowing capacity. By carefully weighing the risks and benefits of FHA loans and working with a knowledgeable lender, borrowers with low credit scores can make informed decisions about their home-buying options.