VA Loans With Bad Credit

This blog will cover qualifying for VA loans with bad credit. Welcome to the world of VA loans with bad credit. While having a low credit score can pose challenges when securing a home loan, the Department of Veterans Affairs (VA) is committed to helping veterans and active-duty service members achieve their dreams of homeownership. When seeking VA loans with bad credit, it is crucial to work with lenders with expertise and experience handling these loans. These specialized lenders understand the unique challenges faced by borrowers with low credit scores and know to navigate the mortgage loan process in such situations.

VA loans provide a pathway to financing with flexible requirements and favorable terms, even for individuals with low credit scores. In this guide, we will explore. VA loans with bad credit provide valuable insights, tips, and strategies to increase your chances of approval and secure the home you desire.

VA loans are a type of mortgage loan backed by the Department of Veterans Affairs, specifically designed to assist veterans, active-duty service members, and eligible surviving spouses in achieving homeownership. These loans are highly advantageous due to their flexible

requirements and favorable terms. Some key benefits of VA loans include no down payment: One of the most significant advantages of VA loans is that they typically do not require a down payment. This feature allows borrowers to purchase a home without saving for a substantial upfront payment.

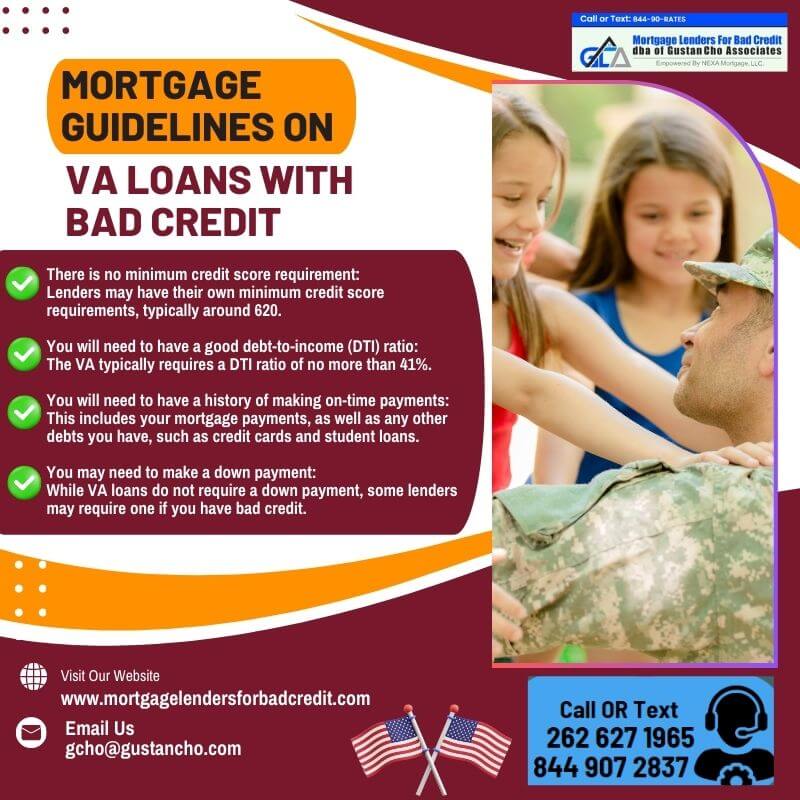

Mortgage Guidelines on VA Loans With Bad Credit

VA loans often come with lower rates than conventional loans. This leads to substantial savings over the loan’s lifespan, making homeownership more affordable for borrowers.

Whether you’re a veteran or an active-duty service member, this guide will help you navigate the process and make informed decisions on your path to homeownership.

VA loans offer the advantage of no private mortgage insurance (PMI), setting them apart from conventional loans. With a VA loan, borrowers are not burdened with the additional cost of PMI, resulting in lower monthly mortgage payments. These significant savings can give borrowers more financial flexibility and peace of mind.

Flexible credit requirements on VA loans With Bad Credit

VA loans are known for their flexibility regarding credit scores. While other loan programs may have strict credit score requirements, VA loans are more lenient, making them accessible to individuals with low credit scores. Obtaining a traditional mortgage loan can be challenging for individuals with low credit scores.

Lenders often have strict credit requirements that make it difficult to qualify. However, VA loans provide an excellent opportunity for borrowers with low credit scores to achieve homeownership by offering more lenient credit requirements and considering factors beyond just credit scores.

VA loans open doors for individuals who may have otherwise been unable to secure a mortgage. This is particularly significant for veterans and active-duty service members who deserve the chance to own a home despite past credit challenges. VA loans with bad credit provide a pathway to affordable homeownership, offering financial stability and the opportunity to build equity over time.

Can I Qualify For VA Loans Bad Credit?

Credit scores are numerical representations of an individual’s creditworthiness and financial history. They are based on payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. Creditworthiness is determined by credit scores, which fall within a range of 300 to 850, with higher scores signifying stronger credit profiles.

Lenders use credit scores to assess the lending risk to borrowers and determine loan eligibility and interest rates. While VA loans are known for their flexibility regarding credit scores, there are still minimum requirements for borrowers. The specific credit score requirements can vary among lenders, but a minimum credit score 620 is typically required to qualify for a VA loan.

Lenders may be open to collaborating with borrowers with lower credit scores, particularly if they exhibit additional compensating factors like consistent income and a strong track record of timely repayments. A low credit score can present challenges when applying for a VA loan. It may affect the borrower’s eligibility for certain loan programs or increase interest rates.

VA Mortgage Guidelines Versus Other Loan Programs

VA loans are more forgiving than traditional loans regarding credit scores. The Department of Veterans Affairs recognizes that individuals with low credit scores may have faced financial hardships due to military service or other circumstances. As a result, they consider factors beyond just credit scores when evaluating loan applications, such as the borrower's income stability, debt-to-income ratio, and the ability to make timely mortgage payments.

While low credit scores may not disqualify borrowers from VA loan eligibility, it is important to note that credit history and scores still play a role in the loan approval process. Lenders will review credit reports and assess the borrower’s overall creditworthiness.

Therefore, borrowers with low credit scores should improve their credit history and scores before applying for a VA loan. Taking steps to pay bills on time, reducing existing debts, and addressing any errors on credit reports can help strengthen creditworthiness and increase the chances of loan approval with favorable terms.

Improving Credit Scores for VA Loans With Bad Credit

Before diving into the VA loan application process, it’s essential to understand how credit scores impact your eligibility and what you can do to enhance them. By implementing these steps to improve your credit scores, you’ll be on your way to securing a VA loan and achieving your homeownership goals. Review and monitor credit reports: Acquire copies of your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion) and meticulously examine them for any inaccuracies or inconsistencies.

Dispute any inaccuracies and ensure that the information on your reports is up-to-date and correct. Pay bills on time: Maintaining a track record of punctual payments is key to enhancing credit scores.

Consider establishing automated payments or setting reminders to help guarantee timely payments for all your financial obligations, such as credit cards, loans, and utility bills. Reduce debt: Reducing your overall debt load can have a favorable effect on your credit scores. Formulate a budget and devise a strategy to eliminate high-interest debts, such as outstanding credit card balances or personal loans. Make it a priority to tackle debts with the highest interest rates first while ensuring that you meet at least the minimum payment requirements for your other accounts.

How To Boost Credit To Qualify For VA Loans with bad credit

Multiple credit inquiries can temporarily lower your credit scores. Minimize new credit applications, especially before applying for a VA loan, as each inquiry can leave a mark on your credit report. Only apply for credit when necessary, and quickly shop around for the best rates to minimize the impact. Maintain a healthy credit utilization ratio:

Strive to maintain your credit card balances at or below 30% of your available credit limit. Elevated credit utilization can hurt your credit scores, so contemplate reducing your balances or inquiring about a credit limit increase to decrease your utilization ratio.

Establishing and preserving a good credit history is essential when obtaining a VA loan. Lenders carefully evaluate your creditworthiness, and having a strong credit profile can significantly impact your loan approval and terms. Building a positive credit history and managing debt responsibly demonstrate your financial responsibility and make you a more attractive borrower.

How To Re-Establish Your Credit With Secured Credit Cards

Establishing a credit history can be beneficial if you have limited credit experience. You might consider exploring options like applying for a

secured credit card or becoming an authorized user on another person’s credit card. Use these accounts responsibly, making small purchases and paying off monthly balances to establish a good credit history. Ethel Matthews, a dually licensed realtor and loan officer, advises the following:

You do not need to hire a credit repair company to rebuild your credit to qualify for a VA loan. The Mortgage Lenders For Bad Credit team are experts in rebuilding credit and can offer valuable educational resources and workshops to deepen your understanding of credit and financial management.

Remember, improving credit scores takes time and commitment. Being patient and diligent in managing your finances responsibly is essential. Taking proactive steps to improve your credit can increase your chances of VA loan approval and secure better loan terms. Diversify your credit mix: Showcasing your ability to handle different types of credit responsibly can be accomplished by having a blend of credit cards, installment loans, and a mortgage. However, only pursue new credit accounts if they are essential and can be comfortably managed within your budget.

How To Get AUS Approval For VA loans with bad credit

Closing old accounts may negatively impact your credit scores. Even if you no longer use a credit card, keeping the account open, occasionally making small purchases, and paying them off can help maintain a positive credit history. If you require assistance enhancing your credit scores, seeking guidance from credit counseling services or professionals may be beneficial. Alex Carlucci, an expert in helping borrowers with credit scores down to 500 FICO, advises the following:

Loan officers experts on VA loans withbad credit can provide personalized strategies to manage your debts, create a budget, and enhance your creditworthiness.

Effectively demonstrating compensating factors, you can present a compelling case to lenders and offset the impact of low credit scores on your VA loan application. Collaborating closely with your loan officer is crucial in identifying and effectively communicating these factors. With their expertise in evaluating such circumstances, they can offer valuable guidance on presenting your case in the best possible way.

Manual Underwriting Guidelines on VA Loans

Regarding VA loans, manual underwriting is available to assist borrowers who cannot get an approve/eligible per the automated underwriting system. VA manual underwriting provides opportunities for homeownership to individuals needing to meet the standard credit score requirements. Manual underwriting recognizes that credit scores sometimes reflect an individual’s ability to repay a loan and consider alternative factors for loan approval. Dale Elenteny, an expert on VA manual underwriting guidelines, shares the following information:

To qualify for manual underwriting on VA loans, borrowers must meet specific eligibility criteria. While the requirements may vary, lenders may consider factors such as income stability, employment history, debt-to-income ratio, overall financial stability, and credit scores. It’s important to consult with a VA loan specialist or lender familiar with manual underwriting to understand the specific eligibility requirements and considerations.

Manual underwriting on VA loans can benefit borrowers. Manual underwrites on VA loans offer opportunities for individuals with less-than-perfect credit to access favorable loan terms, including competitive interest rates. There is no down payment on VA loans. There is no maximum income cap on VA loans. It’s important to understand that these programs may have limitations.

Compensating Factors for VA Loans With Bad Credit

Compensating factors are additional strengths or positive attributes in your financial profile that can offset the impact of low credit scores. While credit scores are important in VA loan approval, demonstrating compensating factors can help compensate for lower credit scores and increase your chances of getting approved. These factors offer a more comprehensive perspective on your financial stability and capacity to repay the loan. To enhance your chances of VA loans with bad credit, it’s crucial to highlight the positive aspects of your financial profile, advises Alex Carlucci of Mortgage Lenders For Bad Credit:

Borrowers can qualify for VA loans with bad credit, stable employment history, consistent income, low debt-to-income ratio, significant savings or assets, and a demonstrated ability to manage their finances responsibly. By emphasizing these strengths, you can demonstrate to lenders that you are a reliable borrower capable of fulfilling your mortgage obligations despite your low credit scores.

In addition to highlighting positive aspects of your financial profile, providing additional documentation or explanations can strengthen your VA loan application. This may include explanations for past financial hardships that led to low credit scores, proof of efforts to improve your credit, and evidence of responsible financial behavior such as on-time bill payments or savings contributions. By providing this information, you can give lenders a more comprehensive understanding of your creditworthiness and demonstrate your commitment to overcoming past challenges.

Working with Lenders Experienced in VA Loans With Bad Credit

Look for lenders who specifically advertise their expertise in assisting borrowers with low credit scores. Read customer reviews, check their track record, and inquire about their success rates in securing VA loans with bad credit for borrowers with similar credit profiles, advises Ronda Butts, a dually licensed realtor and loan officer at Mortgage Lenders For Bad Credit.

The team at Mortgage Lenders For Bad Credit can provide valuable insights, guidance, and solutions tailored to your specific credit circumstances, increasing your chances of loan approval. To find lenders experienced in VA loans with bad credit, conducting thorough research and comparing different options is important.

Additionally, consider their responsiveness, communication style, and willingness to guide you through the process. Once you have identified lenders experienced in VA loans with bad credit, it is essential to collaborate with them to explore suitable loan options and terms. Share your financial situation, including your credit history, income, and debt obligations, to help them assess your eligibility and suggest the most appropriate loan programs.

VA Loans With Bad Credit Post-Purchase Considerations

Once you’ve obtained VA loan approval, understanding the responsibilities and benefits of homeownership is important. As a homeowner, you’ll be free to personalize and maintain your property, build equity over time, and enjoy the stability of having a place to call your own. Ronda Butts, a dually licensed realtor and loan officer, advises homeownership includes responsibilities such as mortgage payments, property maintenance, and complying with homeowners& association rules if applicable.

It’s essential to be prepared for these responsibilities and factor them into your budget and long-term financial planning. While you’ve successfully obtained VA loans with bad credit, it’s crucial to continue improving your credit for future financial goals. Building and maintaining good credit habits can help you access better loan terms, lower interest rates, and wider financial opportunities.

Some strategies to consider include making timely bill payments, keeping credit card balances low, avoiding new debt, regularly reviewing your credit report for errors, and responsibly managing any existing debt. Demonstrating responsible credit behavior can improve your credit scores over time and enhance your overall financial well-being.

VA Interest Rate Reduction Refinance Loan

Once you close on your VA loan, you should start working on re-building and boosting your credit. The higher your credit scores, the lower your rate. You can do a VA streamline refinance mortgage loan after making six payments on your VA loan. Individuals with lower credit scores might encounter comparatively higher interest rates than those with higher scores.

Not all mortgage lenders have the same guidelines on VA loans. Lenders may impose overlays on credit scores, debt-to-income ratio, property types, manual underwriting or other factors. It’s crucial to carefully evaluate the terms and conditions of these specialized programs to ensure they align with your financial goals and circumstances.

Its worth noting that the VA loan program offers opportunities for refinancing, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and the Cash-Out Refinance option. These alternatives can be accessible as you progress towards enhancing your credit and attaining your financial objectives. Consulting with a VA-approved lender or a financial advisor can provide valuable insights and guidance on maintaining good credit and leveraging the benefits of the VA loan program for future refinancing opportunities.

Getting Approved For VA Loans With Bad Credit

In conclusion, while low credit scores may pose initial challenges, the VA loan program offers a pathway to homeownership for individuals with less-than-perfect credit. Borrowers can increase their chances of VA loan approval by taking proactive steps to improve credit,

working with experienced lenders, and leveraging compensating factors. Over 80% of our clients at Mortgage Lenders For Bad Credit are homebuyers who could not get approved at other mortgage companies, says Dale Elenteny:

The loan officers at Mortgage Lenders For Bad Credit can provide valuable advice on improving your creditworthiness, recommend steps to boost your chances of loan approval and present various loan options that align with your financial goals. Working closely with lenders specializing in VA loans with bad credit ensures you receive personalized attention and guidance throughout the loan process.

Their expertise can help you navigate the complexities of credit evaluation, overcome challenges, and secure the most favorable loan terms. Once approved, it’s important to fulfill homeownership responsibilities and continue working towards improving credit for future financial goals. With determination and the support of the VA loan program, owning a home is within reach for those with low credit scores.