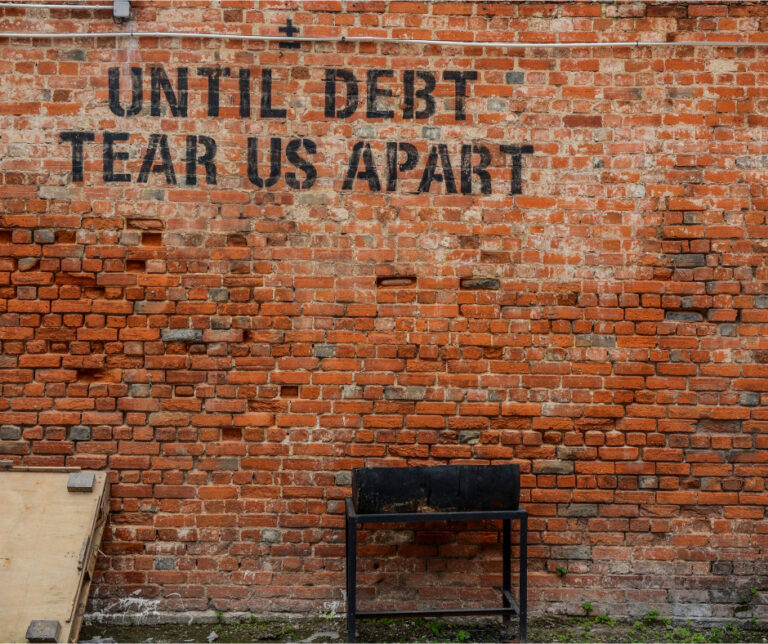

DSCR Loans

Unlocking Financial Freedom: Exploring DSCR Loans for Real Estate Investment: This guide covers DSCR loans for real estate investors. Real estate investment holds tremendous potential for wealth creation and financial freedom. However, securing the necessary financing can be a major hurdle. That’s where Debt Service Coverage Ratio (DSCR) Loans come into play. Ronda Butts, a dually licensed realtor and loan officer at Mortgage Lenders For Bad Credit, explains what DSCR loans are:

Debt-Service Coverage Ratio Loans, often referred to as DSCR loans, is a no-income documentation loan based on the borrowers credit scores, the subject property cash flow, and the down payment the real estate investor puts down on the property. Usually, a 20% down payment is required. The down payment requirement is based on the borrower’s credit scores.

Debt-Service Coverage Ratio Loans, or DSCR Loans, are specialized loans designed to provide real estate investors with the means to acquire properties and generate cash flow. This guide will explore DSCR Loans’ definition, benefits, and considerations. Whether you’re a seasoned investor or new to the real estate market, understanding DSCR Loans can be the gateway to unlocking your journey toward success in real estate investment.

Definition and Purpose of Debt Service Coverage Ratio – DSCR Loans

DSCR Loans are instrumental in real estate investment, granting investors access to financing based on a property’s income potential. These loans are financial tools that assess the property’s capacity to generate sufficient income to meet its debt obligations. By leveraging capital and expanding investment portfolios, investors can seize growth opportunities. Structured to guarantee adequate cash flow for loan repayment, DSCR Loans have advantages like larger loan amounts, competitive interest rates, and flexible repayment terms. Nevertheless, before proceeding, borrowers must conscientiously assess factors such as income stability, market conditions, and the impact of loan terms on cash flow.

Understanding DSCR Loans

The Debt Service Coverage Ratio (DSCR) is a crucial metric used in real estate financing. It measures the property’s ability to generate sufficient income to cover its debt obligations. DSCR calculates the property’s net operating income (NOI) by its total debt service (principal and interest payments). DSCR Loans differ from traditional mortgages in their evaluation process. While traditional mortgages primarily consider the borrower’s creditworthiness, DSCR Loans focus on the property’s income potential.

- Higher loan amounts- DSCR Loans typically allow borrowers to access larger loan amounts, enabling them to invest in higher-value properties.

- Competitive interest rates – Due to the emphasis on property income, DSCR Loans often have competitive interest rates aligning with the property’s cash flow potential.

- Flexible repayment terms – Borrowers may enjoy more flexible repayment terms with DSCR Loans, allowing them to customize the loan structure to fit their investment strategy. However, there are limitations to consider:

- Stringent property evaluation – Lenders thoroughly assess the property’s income potential, requiring strong cash flow and stability to meet DSCR requirements.

- Limited personal credit impact – While personal credit is considered in the loan evaluation process, it carries less weight than traditional mortgages.

Borrowers should be aware that DSCR Loans may not significantly impact their personal credit history. Understanding the concept of DSCR, the differences from traditional mortgages, and the benefits and considerations of DSCR Loans equips borrowers with the knowledge needed to make informed decisions in real estate investment financing.

Qualifying for DSCR Loans

Eligibility criteria for borrowers: To qualify for a DSCR Loan, borrowers must meet certain eligibility criteria, which may vary among lenders. Typical requirements include:

- Property type – DSCR Loans are commonly available for commercial properties, including multi-family residences, office buildings, retail spaces, and industrial properties.

- Property income – The property should demonstrate a strong income potential, usually assessed through historical income records and projections.

- Borrower experience – Lenders may consider the borrower’s experience and track record in real estate investment, particularly for larger loan amounts.

- Down payment – Borrowers may be required to provide a down payment, typically ranging from 20% to 30% of the property’s purchase price.

- Required documentation and verification process – To apply for a DSCR Loan, borrowers must gather and submit specific documentation, which may include the following:

- Property financials – Lenders will require detailed financial statements for the property, including income statements, rent rolls, and operating expenses.

- Personal financial information – Borrowers may need to provide personal financial statements, tax returns, and credit history information.

- Property appraisal – Lenders typically require a professional appraisal to assess the property’s market value.

Lenders assess the property’s DSCR to determine the loan amount and terms. This approach enables borrowers to secure financing even if their financial situation may not meet the criteria for a traditional mortgage. DSCR Loans offer distinct advantages for borrowers in real estate investment:

Business Plan on How DSCR Loans Works

Borrowers may be asked to present a comprehensive business plan that outlines their investment strategy and projects future income. The verification process involves lenders reviewing the documentation provided, conducting due diligence on the property, and assessing the borrower’s financial capacity and experience. DSCR requirements vary depending on the lender and the specific loan program. John Strange, a senior loan officer at Mortgage Lenders For Bad Credit, explains how DSCR Loans work:

Typically, lenders look for a DSCR of at least 1.2 to 1.3, meaning the property’s income should be 1.2 to 1.3 times the total debt service. Higher DSCR ratios are generally more favorable and give borrowers a stronger financial position. DSCR calculates the property’s net operating income (NOI) by its total debt service (principal and interest payments).

Lenders use this ratio to determine the loan amount they will provide, ensuring the property generates sufficient cash flow to cover the debt obligations. Meeting the eligibility criteria, gathering the required documentation, and understanding the DSCR requirements and calculations are essential to qualifying for a DSCR Loan. By preparing and presenting a comprehensive package, borrowers can enhance their chances of obtaining financing for their real estate investment ventures.

Exploring Mortgage Options of DSCR Loans

Exploring DSCR loan options allows borrowers to access various financing sources tailored to their needs. Traditional lenders offer stability and expertise, while alternative financing options provide flexibility and expedited processes. Government-backed programs can provide additional support and specialized loan programs. By considering these various options, borrowers can identify the most suitable DSCR Loan source that aligns with their investment objectives and financial requirements.

Traditional lenders offering DSCR Loans

Many traditional lenders, such as commercial banks, credit unions, and mortgage companies, offer DSCR Loans. These lenders have experience in real estate financing and provide various loan options to accommodate different borrowers’ needs. Traditional lenders often have established underwriting processes and may offer competitive interest rates and favorable loan terms.

Alternative financing options for DSCR Loans

In addition to traditional lenders, alternative financing sources exist for DSCR Loans. These may include private lenders, crowdfunding platforms, and real estate investment groups. Alternative financing options provide more flexibility and faster approval processes than traditional lenders.

Borrowers should carefully review terms, interest rates, and fees associated with these options to ensure they align with their investment goals. Government-backed programs and initiatives for real estate investment. Government-backed programs and initiatives can benefit real estate investors seeking DSCR Loans.

The Small Business Administration (SBA) offers the SBA 504 Loan program, which assists small businesses in acquiring commercial real estate. The U.S. Department of Agriculture (USDA) also provides loans for rural property development. Additionally, programs like the Federal Housing Administration (FHA) and the U.S. Department of Veterans Affairs (VA) offer financing options for specific property types and borrower profiles.

Applying for DSCR Loans

A step-by-step guide to the application process. Monitoring and managing expenses related to property maintenance, repairs, insurance, and property management fees is essential. By implementing efficient expense management strategies, borrowers can optimize cash flow and maintain healthy financial stability. Regularly reviewing rental rates is another critical aspect of cash flow management. Conducting rent reviews enables property owners to ensure that rental rates are competitive and reflect the property’s market value. Adjusting rental rates periodically can positively impact cash flow, increase rental income, and contribute to the property’s long-term financial success.

Research lenders

Begin by researching lenders who offer DSCR Loans and evaluate their loan programs, interest rates, terms, and eligibility requirements. Refinancing can lead to lower monthly payments or reduced interest expenses, ultimately improving the borrower’s financial position—cash flow management for real estate investments. Effective cash flow management is essential for real estate investments financed by DSCR Loans. Accurate income projections ensure the property’s projected income aligns with market conditions and fluctuations. Regularly evaluating and adjusting income projections helps maintain realistic expectations and allows for proactive financial planning. Controlling expenses is equally important in managing cash flow.

Pre-qualification

Contact the selected lender to discuss your investment goals and determine if you meet their initial qualification criteria. This step helps you gauge your eligibility before proceeding with the formal application.

Formal application

Complete the lender’s application form, providing accurate and detailed information about the property, financial situation, and investment plans. Being proactive and adaptable allows borrowers to make informed decisions, adjust their strategies as needed, and capitalize on potential opportunities. In conclusion, managing a DSCR Loan involves careful debt service management, effective cash flow management for real estate investments, and strategic risk mitigation strategies. By following these principles, borrowers can navigate the loan successfully and optimize their real estate investment endeavors.

Submit documentation

Gather and submit the necessary financial statements, property records, personal financial information, and any additional documentation

required by the lender. By following a step-by-step application process, preparing the required financial statements and documentation, and understanding the role of a loan underwriter, borrowers can navigate the DSCR Loan application process more confidently. Being organized and providing accurate information enhances the likelihood of a smooth and successful loan approval.

Property evaluation

The lender will thoroughly evaluate the property, including its income potential, market value, and feasibility for loan approval. Once the lender reviews your application and supporting documents, they will initiate the underwriting process to assess your creditworthiness and determine the loan terms and conditions. Lenders will review your credit history and credit scores to evaluate your creditworthiness and repayment capacity. Furnish property-related documents such as title deeds, property insurance information, and other relevant legal documents.

Mortgage Loan approval and closing

You will receive a loan commitment letter outlining the terms and conditions if your application gets approved. The loan can be finalized after completing any remaining paperwork and fulfilling closing requirements. To support your DSCR Loan application, you must prepare the following financial statements and documentation. Property financials include income statements, rent rolls, operating expenses, and property management agreements.

Personal financial statements provide information on your assets, liabilities, income, and expenses. This aids lenders in evaluating your overall financial well-being and ability to repay the loan. Submit personal and business tax returns for the past few years to verify your income and financial stability.

A loan underwriter plays a crucial role in the DSCR Loan application process. They assess the loan application, review the supporting documents, and evaluate your creditworthiness and risk profile. Underwriters analyze your income, assets, liabilities, credit history, and property financials to determine the loan’s feasibility and appropriate terms. They ensure the loan aligns with the lender’s risk tolerance and guidelines. The underwriter’s objective is to decide whether to approve the loan and establish the terms and conditions that protect both the borrower and the lender.

Managing DSCR Loans

Debt service management and loan repayment. Effective management of a DSCR Loan involves conscientious debt service management and timely loan repayment. It is imperative to create a well-defined repayment plan that aligns with the agreed-upon terms of the loan. This includes making consistent monthly payments and ensuring sufficient funds are allocated to cover debt service obligations. Dale Elenteny advises the following:

By adhering to a structured repayment plan, borrowers can demonstrate financial responsibility and maintain a positive relationship with the lender. Additionally, it is prudent to maintain a cash reserve specifically designated for loan repayment. This reserve acts as a safety net, ensuring enough funds are available to cover loan payments during periods of reduced income or unexpected expenses.

By building and preserving a cash reserve, borrowers can safeguard their ability to meet their financial obligations. Monitoring interest rates is another important aspect of managing a DSCR Loan. Staying informed about interest rate fluctuations allows borrowers to evaluate opportunities for refinancing if more favorable terms become available.

Strategies for mitigating risks and maximizing returns

Mitigating risks and maximizing returns are key considerations in managing a DSCR Loan for real estate investment. One effective strategy is diversifying the investment portfolio by spreading investments across different properties and locations. Diversification helps mitigate

risks associated with market fluctuations and economic downturns. By having a diversified portfolio, borrowers can mitigate the potential negative impact of any single property or market. Thorough due diligence is crucial before acquiring a property.

Conducting comprehensive research and analysis, including evaluating factors such as location, tenant stability, market trends, and potential growth opportunities, enables borrowers to make informed investment decisions. Thorough due diligence reduces the risk of making poor investment choices and increases the potential for long-term success. Maintaining the value of the property is another critical strategy for maximizing returns.

Regular maintenance and improvement of the property help preserve its value and attractiveness to tenants. Property owners can command competitive rental rates, increase rental income, and achieve long-term appreciation by ensuring that the property remains in good condition and meets tenant expectations. Staying informed about market trends, economic indicators, and regulatory changes is also essential for effective risk management and maximizing returns. By keeping abreast of industry developments, borrowers can anticipate and adapt to changes in the market.

Common Challenges and Solutions

Obtaining DSCR Loans may present certain challenges for borrowers. Some common obstacles include stringent eligibility criteria, higher down payment requirements, and potential limitations on loan amounts. To overcome these challenges, borrowers can explore alternative lenders specializing in DSCR Loans or government-backed programs to support real estate investment. Additionally, improving credit scores, increasing income stability, and maintaining a strong financial profile can enhance eligibility and improve the chances of loan approval.

Managing real estate investments financed by DSCR Loans can come with financial and investment-related challenges. Fluctuating rental income, unexpected property expenses, and market volatility are some of the issues that borrowers may encounter—conducting thorough due diligence before investing is crucial to address these challenges, ensuring that the property’s income potential aligns with the loan repayment requirements.

Building contingency plans and maintaining cash reserves can help mitigate financial risks and cushion during reduced income or unforeseen expenses. Additionally, implementing proactive property management strategies, such as regular maintenance, tenant retention efforts, and market analysis, can help optimize rental income and minimize vacancies. Monitoring market trends and staying informed about economic indicators can aid in making informed investment decisions and adjusting strategies as needed.

Getting Pre-Approved For DSCR Loans

When faced with challenges or uncertainties, seeking professional advice and utilizing available resources can provide valuable support. Consulting with experienced real estate professionals, such as real estate agents, financial advisors, or mortgage brokers, can offer

guidance on navigating the complexities of DSCR Loans and real estate investments.

These professionals can provide insights into market conditions and investment strategies and help borrowers make informed decisions. In addition to seeking professional advice, resources such as educational materials, online forums, and industry associations can provide valuable information and networking opportunities.

These resources can enhance knowledge, expand networks, and connect borrowers with like-minded individuals who have faced similar challenges. By proactively addressing potential obstacles, overcoming financial and investment-related challenges, seeking professional advice, and utilizing available resources, borrowers can increase their chances of success in managing DSCR Loans and achieving their real estate investment goals.

Are DSCR Loans The Best Loans For Real estate Investments

In conclusion, DSCR Loans offer real estate investors a valuable financing tool based on a property's income potential. Understanding the Debt Service Coverage Ratio concept and its benefits can empower investors to make informed decisions and expand their investment

portfolios. Qualifying for a DSCR Loan requires meeting eligibility criteria, providing necessary documentation, and meeting specific DSCR requirements.

Exploring various DSCR Loan options, including traditional lenders, alternative financing, and government-backed programs, allows investors to choose the best fit for their needs. Applying for a DSCR Loan involves following a step-by-step process, preparing required financial statements, and understanding the role of loan underwriters.

Managing a DSCR Loan involves effective debt service management, cash flow management, and implementing strategies to mitigate risks and maximize returns. Addressing common challenges by seeking solutions, overcoming obstacles, adapting to financial and investment-related challenges, seeking professional advice, and utilizing available resources. By effectively managing a DSCR Loan, investors can navigate the complexities of real estate investment and achieve their financial objectives.